This guide will walk you through how you can produce an invoice with no VAT value to send to the insurance company and an invoice with no NET value that can be sent to your customer. Both invoices will be importable to sage or Xero.

You will need to do this when dealing with insurance companies as they are exempt from VAT. This means that they are not subject to VAT, and therefore do not incur the standard 20% VAT charge so you may decide to pass these charges on to your customer. Please follow the link below for more information on this.

VAT and insurance claims - Tax Insider

Business case

Insurance companies will pay VAT on any damage but they may not pay VAT on any extras. for example you may need to collect the vehicle from them after the repairs are done. the insurance company will pay the net for the collection but they will not pay the Vat. This is where you will need to pass the Vat charge to your customer. this may apply to any other extras such as re-panelling, delivery, Valet charge or any other admin fees. Essentially the only thing that is actually Vatable is the damage. Anything else is not Vatable.

I will be walking you through this process in 2 sections. Section 1 will walk you through the invoice for the insurance company and section 2 will walk you through invoicing your customer. Both sections will assume you are able to access the booking screen and raise a sundry invoice on your own. If you need any help creating a booking/invoice, please follow the link bellow to our knowledge base portal.

Section 1. NET Invoice for the insurance company:

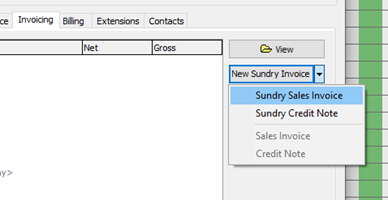

- Create a new sundry sales invoice.

2. Change the client to the insurance company this will be sent to.

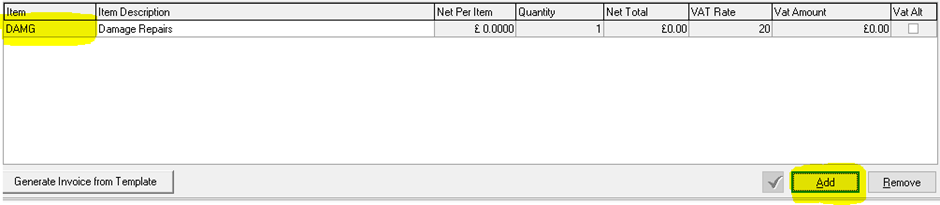

3. Add the charge Item. I will be using damage, but you can use any charge that works in this situation. You may also want to change the charge description to be more appropriate.

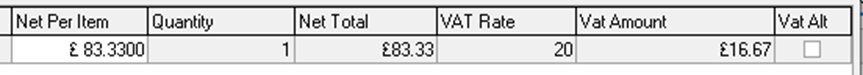

4. Add the net amount. If you only have a gross figure to work with and need to work out what the charge will be ex VAT, you can use a VAT calculator. I have included a link to a VAT calculator below.

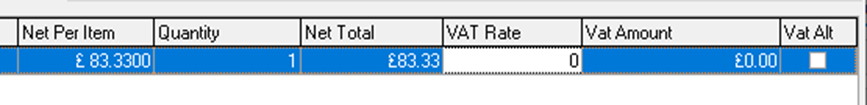

you will notice that as I have added the amount in the “NET” field it has worked out how much VAT there will be to pay and what the VAT rate is. All you will need to do is remove the VAT rate and the VAT amount will change to 0. See below.

5. You can now finalise the invoice and email it to the insurance company as you normally would.

Section 2. VAT invoice for the customer

1. Create a new sundry sales invoice.

2. Add the charge Item. I will be using damage, but you can use any charge that works in this situation. You may also want to change the charge description to be more appropriate.

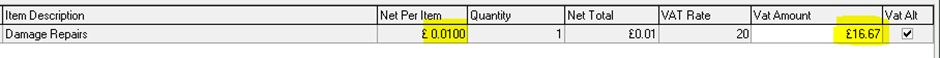

3. You will then need to change the Net per item to £0.01. the reason we do this is because you can be a penny out on invoices and Sage/Xero will recognise this as a positive figure. If we were to add £0 you will be unable to post. You will then need to add the VAT amount.